iowa inheritance tax return schedules

Iowa InheritanceEstate Tax Return IA 706 Step 4. If the deceased persons net estate discussed below is worth 25000 or less no.

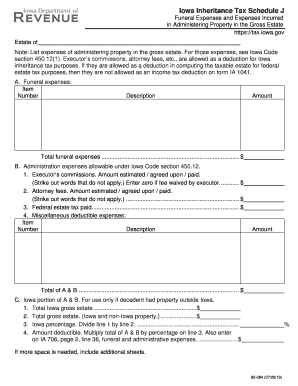

The inheritance tax return must be filed and any tax due must be paid on or before the last day of the ninth month after the death of the decedent or life tenant.

.png)

. Track or File Rent Reimbursement. 0-12500 has an Iowa inheritance tax rate of 5. If your relation to the person leaving you money is any of the above you wont owe inheritance tax regardless of the size of your inheritance.

While the top estate tax rate is 40 the average tax rate paid is just 17. If the estate has filed a federal estate tax return a copy must be submitted with the Iowa inheritance. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent.

Enter this on line 1. If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return. Complete the separate schedules A E and G to determine the total value of all real estate.

An extension of time to file the return and make. Fiduciary IA 1041 Schedule I Iowa Alternative Minimum Tax Franchise. Learn About Property Tax.

Change or Cancel a Permit. 12501-25000 has an Iowa inheritance tax rate of 6. While the top estate tax rate is 40 the average tax rate paid is just 17.

Dup 219 gdb put learn about sales use tax. Iowa Inheritance Tax Schedule I 60-083. An extension of time to file the return and make.

Iowa Inheritance Tax Schedules. A bigger difference between the two states is how the exemptions to the tax work. An extension of time to file the.

The departments Inheritance Tax Return and the liabilities Schedules J and K will be accepted. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent. A summary of the different categories is as follows.

Iowa Inheritance Tax Return Schedules. 25001-75500 has an Iowa inheritance tax rate of 7. What is US inheritance tax rate.

Department forms must be used for the Iowa inheritance tax return and Schedules J and K. Stay informed subscribe to receive updates. The Departments inheritance tax return and the liabilities Schedules J and K will be accepted.

Register for a Permit. Iowa is planning to completely repeal. The Iowa inheritance tax rate varies depending on the relationship of the inheritors to the deceased person.

That is worse than Iowas top inheritance tax rate of 15. If the net value of. Learn About Sales.

An Iowa inheritance tax return must be filed if estate assets pass to both an individual listed in Iowa Code section 4509 and that individuals spouse. IA 1120F Franchise Return for Financial Institutions Franchise IA 1120F Franchise Estimated Worksheet. The vast majority of estates 999 do not pay federal estate taxes.

4504 additionally no inheritance tax return is required if the. What is the federal inheritance tax rate for 2020. Inheritance Tax Rates Schedule.

If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return.

Fillable Online Iowa Inheritance Tax Schedule J Iowa Department Of Revenue Fax Email Print Pdffiller

Appliction For Refund Of Inheritance Or Estate Tax Rev 1313 Pdf Fpdf Docx

How To Pay Inheritance Tax With Pictures Wikihow Life

Billings Mensen Red Oak Ia Law Lawyerland

Fillable Online Iowa Inheritance Tax Schedule J Fax Email Print Pdffiller

Recent Changes To Iowa Estate Tax 2022 Youtube

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Ia 1040 Schedules A And B 41 004 Iowa Department Of Revenue Iowa Fill Out And Sign Printable Pdf Template Signnow

Gift Tax Does This Exist At The State Level In New York

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

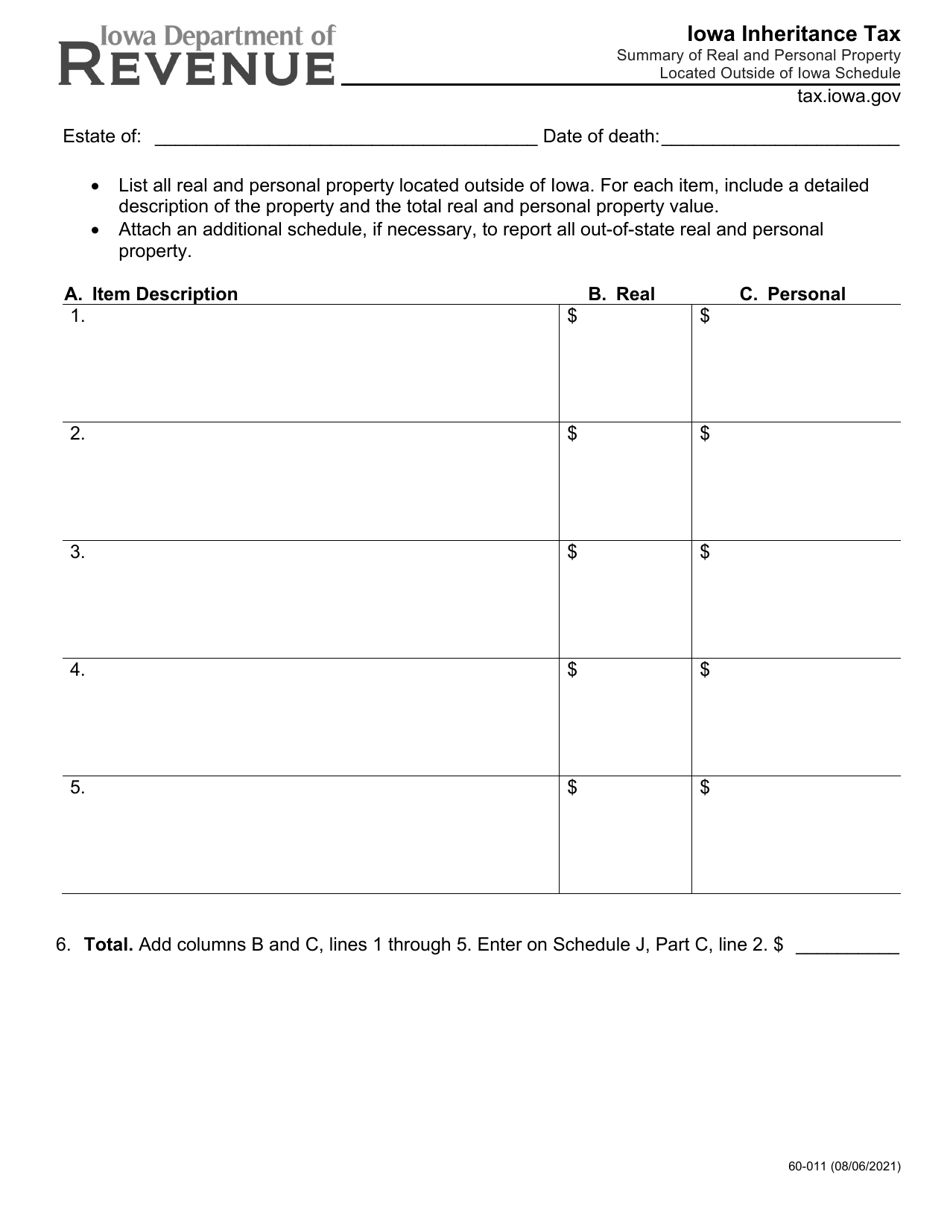

Form 60 011 Download Printable Pdf Or Fill Online Iowa Inheritance Tax Summary Of Real And Personal Property Located Outside Of Iowa Schedule Iowa Templateroller

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Tennessee Short Form Inheritance Tax Form 2000 Fill Out Sign Online Dochub

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Tenncare Tax Waiver Fill Out Sign Online Dochub

How Much Is Inheritance Tax Community Tax

Iowa State Back Taxes Understand Tax Relief Options And Consequences

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)